30 Oct 2014

Yesterday, I wanted to calculate the significance of Pearson correlation coefficients between two series of data. I knew that I could use a Student's t-test for this purpose, but I did not know how to do this in Excel 2013. And, to be honest, I did not really understand the documentation of Excel's T.TEST formula. So, here is what I did.

This video explains how to calculate Pearson coefficient and p-value in excel.Related Videos:-. Finding P-Value for correlation in excel is a relatively straightforward process, but there is no single function for the task; we will see the example for the same. The formula to calculate the P-Value is TDIST (x, degfreedom, tails). If r xy 0 AND t 1.984 then the Pearson correlation coefficient is significantly positive. This would be reported more compactly as: r xy (98) = value, p value is of course the calculated Pearson correlation coefficient. If r xy 1.984 then the Pearson correlation coefficient is significantly.

Pearson correlation coefficient

First, I had to calculate the corresponding Pearson correlation coefficients according to this formula:

where rxy is the Pearson correlation coefficient, n the number of observations in one data series, x the arithmetic mean of all xi, y the arithmetic mean of all yi, sx the standard deviation for all xi, and sy the standard deviation for all yi.

Let's assume, the data series to be correlated are stored in arrays A1:A100 and B1:B100, thus n = 100:

=PEARSON(A1:A100;B1:B100)

Alternatively, you could also use the Correl function, which returns the same result:

=CORREL(A1:A100;B1:B100)

(I am using a Swiss German localization, therefore Excel's delimiter for formula arguments is a semicolon ; rather than a comma , in my case.)

Naturally, the returned correlation value is in the range of -1.0 to +1.0. This value is often referred to as Pearson r or rxy in our case.

t-value

Next, I calculated the corresponding t-values according to this formula:

where t is the t-value, which can be positive for positive correlations or negative for negative correlations, rxy is the already calculated Pearson correlation coefficient, and n is the number of observations again (here n = 100).

Significance testing

Finally, I needed to decide whether the computed t-values were actually significant or not. For this purpose, we need to compare them to pre-calculated t-values available in a t-value table. To do so, it is necessary to decide upon two things:

- What is the desired significance or confidence level, e.g. 95% or 99%?

- Do I want to use a one-tailed or a two-tailed t-test?

In my case, I decided to use a 95% significance level (which is a very common choice for data that are not highly critical). What confused me for some time is that some sources like the already linked Wikipedia-article express confidence positively by stating the degree of certainty (e.g. 0.95 or 95%), whereas others like this one express confidence negatively by the probability for being wrong (e.g. 0.05 or 5%). Other sources again like this one actually state both in a single table. It is essential that you know what the source you are using is referring to! You can always carefully compare the t-values contained in different t-tables with each other to get an understanding whether someone actually takes one or the other perspective. Just check the t-table's header line containing the probability values. Usually, the t-values are in ascending order from left to right, and in descending order from top to bottom. Hence:

If you want to test the significance of a negative correlation, then you must check whether your t-value t is below a certain critical negative t-value tcrit at the left side of the t-distribution: Is t < tcrit?

Usually, a t-table only includes positive t-values, but not negative ones. How can we then test for the significance of negative correlations? It's really easy. t-distributions are symmetric with a median of 0, thus their left and right tails look exactly the same. For this reason, we can change our test from 'Is t < tcrit?' to 'Is ABS(t) > tcrit?'. Instead of checking whether our t-value is below a critical negative threshold, we actually check whether its absolute value is greater than a critical positive threshold.

In case you do not have a very clear idea whether the expected correlation is actually positive or negative because it could be both it is better to use a two-tailed t-test. You can use a one-tailed t-test if you are only interested in one directionality of the correlation but not in the other (e.g. only positive but not negative, or only negative but not positive). Always remember:

p(t) two-tailed = 2 * p(t) one-tailed

The t-table contains in the first column the degrees of freedom. This is usually the number of observations n (i.e. 100) minus some value depending on the context. When computing significances for Pearson correlation coefficients, this value is 2: degrees of freedom = n - 2.

We now have all information needed to perform the significance test. i) We have decided upon a confidence level of 95%, ii) we have decided to use a two-tailed t-test, iii) we have calculated the degrees of freedom to be 98 = 100 - 2. Looking up the critical threshold tcrit in the t-table we find that it is 1.984. Therefore:

- If rxy > 0 AND t > 1.984 then the Pearson correlation coefficient is significantly positive. This would be reported more compactly as: rxy(98) = , p < 0.05 (two-tailed), where is of course the calculated Pearson correlation coefficient.

- If rxy < 0 AND ABS(t) > 1.984 then the Pearson correlation coefficient is significantly negative.

- In all other cases the result is not significant.

Using Excel for t-tests

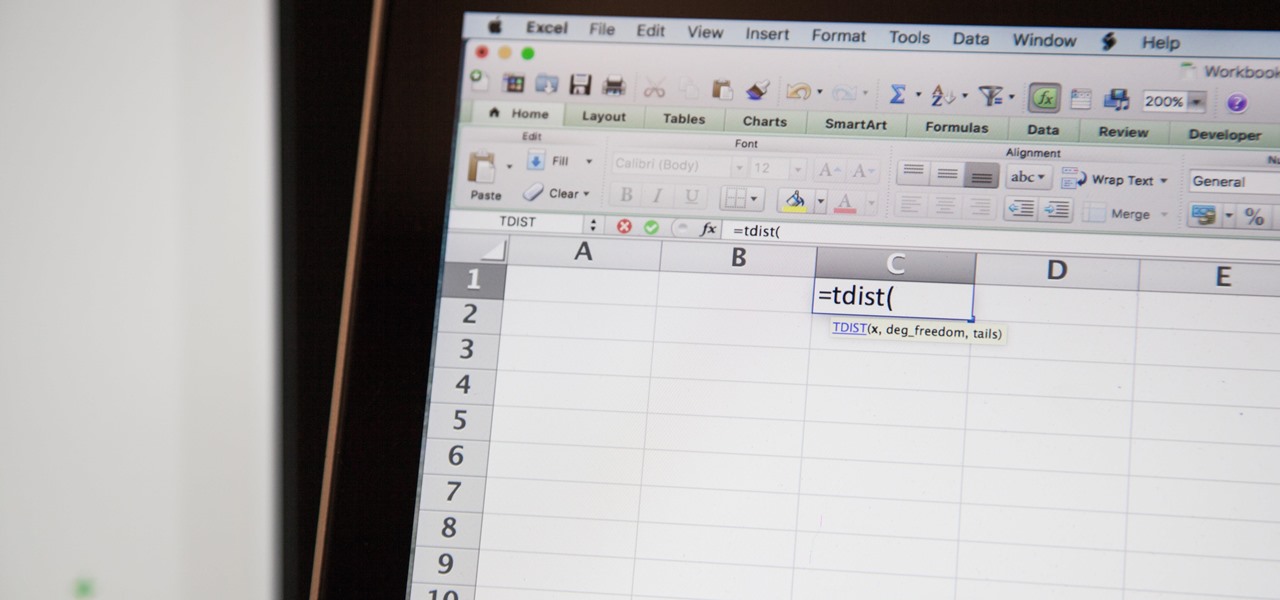

TINV, T.INV.2T, TDIST, and T.DIST.2T

Of course, calculating critical t-values can be done in Excel too. Before Excel 2010, there were only the TINV and TDIST formulas, now there are additionally the T.INV.2T and the T.DIST.2T formulas. All these formulas express confidence negatively, that is the probability value p represents the probability for being wrong.

=TINV(p;df) | returns a t-value t for the given probability p and degrees of freedom df, assuming a two-tailed test. =TINV(p;df) is equivalent to =T.INV.2T(p;df). |

=T.INV.2T(p;df) | returns a t-value t for the given probability p and degrees of freedom df, assuming a two-tailed test. =T.INV.2T(p;df) is equivalent to =TINV(p;df). |

=TDIST(t;df;num-tails) | returns a probability value p for the given t-value t, the degrees of freedom df, and the number of tails num-tails (either 1 or 2). =TDIST(t;df;2) is equivalent to =T.DIST.2T(t;df). Furthermore, =2*TDIST(t;df;1) is equivalent to =T.DIST.2T(t;df). |

=T.DIST.2T(t;df) | returns a probability value p for the given t-value t, the degrees of freedom df, and a two-tailed t-test. =T.DIST.2T(t;df) is equivalent to =TDIST(t;df;2). |

TINV is the inverse of the TDIST formula and vice versa.

=CORREL(A1:A100;B1:B100)

(I am using a Swiss German localization, therefore Excel's delimiter for formula arguments is a semicolon ; rather than a comma , in my case.)

Naturally, the returned correlation value is in the range of -1.0 to +1.0. This value is often referred to as Pearson r or rxy in our case.

t-value

Next, I calculated the corresponding t-values according to this formula:

where t is the t-value, which can be positive for positive correlations or negative for negative correlations, rxy is the already calculated Pearson correlation coefficient, and n is the number of observations again (here n = 100).

Significance testing

Finally, I needed to decide whether the computed t-values were actually significant or not. For this purpose, we need to compare them to pre-calculated t-values available in a t-value table. To do so, it is necessary to decide upon two things:

- What is the desired significance or confidence level, e.g. 95% or 99%?

- Do I want to use a one-tailed or a two-tailed t-test?

In my case, I decided to use a 95% significance level (which is a very common choice for data that are not highly critical). What confused me for some time is that some sources like the already linked Wikipedia-article express confidence positively by stating the degree of certainty (e.g. 0.95 or 95%), whereas others like this one express confidence negatively by the probability for being wrong (e.g. 0.05 or 5%). Other sources again like this one actually state both in a single table. It is essential that you know what the source you are using is referring to! You can always carefully compare the t-values contained in different t-tables with each other to get an understanding whether someone actually takes one or the other perspective. Just check the t-table's header line containing the probability values. Usually, the t-values are in ascending order from left to right, and in descending order from top to bottom. Hence:

If you want to test the significance of a negative correlation, then you must check whether your t-value t is below a certain critical negative t-value tcrit at the left side of the t-distribution: Is t < tcrit?

Usually, a t-table only includes positive t-values, but not negative ones. How can we then test for the significance of negative correlations? It's really easy. t-distributions are symmetric with a median of 0, thus their left and right tails look exactly the same. For this reason, we can change our test from 'Is t < tcrit?' to 'Is ABS(t) > tcrit?'. Instead of checking whether our t-value is below a critical negative threshold, we actually check whether its absolute value is greater than a critical positive threshold.

In case you do not have a very clear idea whether the expected correlation is actually positive or negative because it could be both it is better to use a two-tailed t-test. You can use a one-tailed t-test if you are only interested in one directionality of the correlation but not in the other (e.g. only positive but not negative, or only negative but not positive). Always remember:

p(t) two-tailed = 2 * p(t) one-tailed

The t-table contains in the first column the degrees of freedom. This is usually the number of observations n (i.e. 100) minus some value depending on the context. When computing significances for Pearson correlation coefficients, this value is 2: degrees of freedom = n - 2.

We now have all information needed to perform the significance test. i) We have decided upon a confidence level of 95%, ii) we have decided to use a two-tailed t-test, iii) we have calculated the degrees of freedom to be 98 = 100 - 2. Looking up the critical threshold tcrit in the t-table we find that it is 1.984. Therefore:

- If rxy > 0 AND t > 1.984 then the Pearson correlation coefficient is significantly positive. This would be reported more compactly as: rxy(98) = , p < 0.05 (two-tailed), where is of course the calculated Pearson correlation coefficient.

- If rxy < 0 AND ABS(t) > 1.984 then the Pearson correlation coefficient is significantly negative.

- In all other cases the result is not significant.

Using Excel for t-tests

TINV, T.INV.2T, TDIST, and T.DIST.2T

Of course, calculating critical t-values can be done in Excel too. Before Excel 2010, there were only the TINV and TDIST formulas, now there are additionally the T.INV.2T and the T.DIST.2T formulas. All these formulas express confidence negatively, that is the probability value p represents the probability for being wrong.

=TINV(p;df) | returns a t-value t for the given probability p and degrees of freedom df, assuming a two-tailed test. =TINV(p;df) is equivalent to =T.INV.2T(p;df). |

=T.INV.2T(p;df) | returns a t-value t for the given probability p and degrees of freedom df, assuming a two-tailed test. =T.INV.2T(p;df) is equivalent to =TINV(p;df). |

=TDIST(t;df;num-tails) | returns a probability value p for the given t-value t, the degrees of freedom df, and the number of tails num-tails (either 1 or 2). =TDIST(t;df;2) is equivalent to =T.DIST.2T(t;df). Furthermore, =2*TDIST(t;df;1) is equivalent to =T.DIST.2T(t;df). |

=T.DIST.2T(t;df) | returns a probability value p for the given t-value t, the degrees of freedom df, and a two-tailed t-test. =T.DIST.2T(t;df) is equivalent to =TDIST(t;df;2). |

TINV is the inverse of the TDIST formula and vice versa.

Examples: Let p = 0.05 (5% probability of being wrong), n = 100 (therefore df = 100 - 2 = 98). We assume a two-tailed t-test.

- Calculating t for a given p:

=TINV(0.05; 100-2)==T.INV.2T(0.05; 100-2)= 1.9844675. - Calculating p for a given t:

=TDIST(1.9844675;100-2;2)==T.DIST.2T(1.9844675;100-2)==2*TDIST(1.9844675;100-2;1)= 0.05.

T.INV and T.DIST

Since Excel 2010, there is also a T.INV and a T.DIST formula. Confusingly, they actually work quite differently from TINV and TDIST! First, unlike TINV and TDIST, T.INV and T.DIST by default are one-tailed. Second, unlike TINV and TDIST, T.INV and T.DIST actually express confidence positively, that is the probability value p represents the degree of certainty.

=T.INV(p;df) | returns a t-value t for a given probability p and degrees of freedom df, assuming a one-tailed test. =T.INV(p;df) is equivalent to =TINV(2*(1-p);df). |

=T.DIST(p;df;true) | returns a probability value p for the given t-value t, the degrees of freedom df, assuming a one-tailed t-test. =2*(1-T.DIST(p;df;true)) is equivalent to =TDIST(p;df;2). Furthermore, =1-T.DIST(p;df;true) is equivalent to =TDIST(p;df;1). |

Examples: Let p = 0.05 (5% probability of being wrong), n = 100 (therefore df = 100 - 2 = 98). We assume a two-tailed t-test.

- Calculating t for a given p:

=T.INV(1-0.05/2;98)==TINV(0.05;98)= 1.9844675. - Calculating p for a given t:

=2*(1-T.DIST(1.9844675;98;true))==TDIST(1.9844675;98)= 0.05;

By the way, there is a nice blog post about t-tests in Excel.

Calculate P Value For Pearson Correlation In Excel

Please enable JavaScript to view the comments powered by Disqus.comments powered by DisqusPEARSON function is used to calculate the Pearson correlation coefficient r. This function is used in the work when it is necessary to reflect the degree of linear dependence between two data arrays. In Excel, there are several functions with which you can get the same result, but the universality and simplicity of the Pearson function make a choice in its favor.

How does PEARSON function in Excel?

Consider an example of calculating the Pearson correlation between two data arrays using the PEARSON function in MS EXCEL. The first array represents the temperature values, the second pressure in a certain summer period. An example of a filled table is shown in the figure:

The task is as follows: it is necessary to determine the relationship between temperature and pressure for the month of June.

An example of a solution with the function PEARSON when analyzing in Excel

- Select the cell C17 in which the Pearson criterion should be calculated as the result and press the 'fx' function master button or the hot key combination (SHIFT + F3). The function wizard opens, in the Category field, select 'Statistical'. In the list of statistical functions, select and click Ok:

- In the arguments menu, select Array 1; in the example, this is the morning air temperature, and then Array 2 — atmospheric pressure.

- As a result, in cell C17, we obtain the Pearson correlation coefficient. In our case, it is negative and approximately equal to -0.14.

This indicator -0.14 by Pearson, who returned the function, indicates an unfavorable dependence of temperature and pressure at an early time of day.

PEARSON function step by step instruction

The correlation coefficient is the most convenient indicator of the conjugacy of quantitative traits.

Task: Determine the linear Pearson correlation coefficient.

Solution example:

- The table shows data for a group of smokers. The first array x - represents the age of the smoker, the second array y represents the number of cigarettes smoked per day.

- Select the B4 cell in which the result will be calculated and press the fx function master button (SHIFT + F3).

- In the Statistical group, select the PEARSON function.

- Select Array 1 - smoking age, then Array 2 - the number of cigarettes smoked per day.

- Press the OK button and see the criterion for the normal Pearson distribution in cell B4.

Thus, according to the result of the calculation, the statistical conclusion of the experiment revealed a negative relationship between age and the number of cigarettes smoked per day.

PEARSON correlation analysis in Excel

Task: students were given tests for visual and verbal thinking. The average time to solve test tasks in seconds was measured. The psychologist is interested in the question: is there a relationship between the time for solving these problems?

How To Calculate P-value From Pearson Correlation

Example of a solution: we present the source data in the form of a table:

- Move the cursor to the cell F2. Open the fx function wizard (SHIFT + F3) or enter it manually.

- Choose function.

- Select the array1 B3:B21 with the mouse, then the array2 C3:C21.

- Press OK and in cell F2 we get the Pearson compatibility criterion.

See Full List On Educba.com

Interpretation of the result of the calculation according to Pearson

How Do You Calculate Pearson Correlation Coefficient In Excel

The value of the Pearson linear correlation coefficient cannot exceed +1 and be less than -1. These two numbers +1 and -1 are the boundaries for the correlation coefficient. When the calculation results in a value greater than +1 or less than -1, therefore, an error has occurred in the calculations.

Calculate P Value For Pearson Correlation In Excel Using

If the modulus of the correlation is close to 1, then this corresponds to a high level of coupling between the variables.

How To Find The Pearson Correlation Coefficient In Excel

If the minus sign is received, then the larger value of one sign corresponds to the smaller value of the other. In other words, in the presence of a minus sign, an increase in one variable (sign, value) corresponds to a decrease in another variable. This dependence is called inversely proportional. These provisions are very important to clearly understand for the correct interpretation of the obtained correlation dependence.